Heavy-duty trucking operations require specialized heavy-duty truck insurance due to unique risks like high-value cargo, massive vehicles, and specific equipment. Standard policies often fail to cover these adequately, leaving operators vulnerable. Customized specialized truck insurance offers tailored coverages for towing, loading/unloading liabilities, and heavy equipment damage. Partnering with insurers specializing in this area provides robust protection for trucks, operations, and business continuity, addressing risks like mechanical breakdowns and oversized cargo transport. Keywords: heavy-duty truck insurance, large truck insurance, heavy truck coverage, specialized truck insurance, oversized vehicle insurance, heavy equipment insurance, custom heavy-duty truck policy, insurance for heavy-duty trucks, large vehicle protection.

In the dynamic world of heavy-duty trucking, navigating the road ahead requires more than just skilled driving. Understanding and mitigating unique risks is paramount to ensuring safe, efficient operations. This article delves into the crucial importance of specialized heavy-duty truck insurance for large trucks, exploring tailored solutions that address specific challenges. From customizing your policy to securing oversized vehicle and heavy equipment insurance, discover how to protect your investment and navigate the highway with confidence.

- Understanding the Unique Risks of Heavy-Duty Trucking

- The Importance of Specialized Insurance for Large Trucks

- Customizing Your Policy: Creating a Tailored Heavy Truck Coverage

- Protecting Your Investment: Oversized Vehicle and Heavy Equipment Insurance Options

Understanding the Unique Risks of Heavy-Duty Trucking

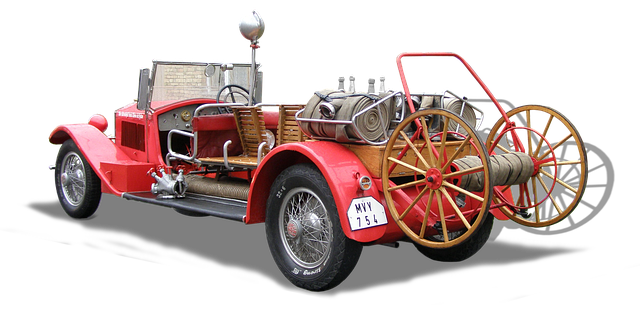

Heavy-duty trucking presents unique risks that standard insurance policies often fail to address adequately. These risks include high-value cargo, heavy vehicles, and specialized equipment that require specific handling and protection. Oversized or unconventional vehicles add another layer of complexity, necessitating customized insurance solutions tailored to mitigate potential liabilities and losses. A comprehensive heavy-duty truck insurance policy should encompass not just liability coverage, but also protection against damage to the vehicle itself, cargo loss or damage, and even downtime due to mechanical failures or accidents.

Specialized truck insurance offers peace of mind for trucking companies by providing customized coverage options aligned with their specific needs. This may include coverages for towing and recovery, loading and unloading liabilities, and even specific types of heavy equipment used in operations. By understanding the unique risks inherent in heavy-duty trucking and partnering with insurers who specialize in this area, businesses can ensure they have robust protection for their valuable assets and operations.

The Importance of Specialized Insurance for Large Trucks

In the world of trucking, where vast and powerful machines navigate highways and byways, ensuring adequate protection is paramount. Heavy-duty trucks, with their oversized dimensions and specialized functions, present unique challenges when it comes to insurance. Regular vehicle insurance often falls short in catering to the specific needs of these behemoth vehicles and their operators. Therefore, a custom heavy-duty truck policy becomes an indispensable asset for several reasons.

Specialized insurance for large trucks, or heavy truck coverage as it’s often termed, accounts for the unique risks associated with this sector. These risks include higher maintenance costs, potential damage to expensive machinery, and the need for specialized transportation. Oversized vehicle insurance, tailored specifically for heavy equipment, ensures that owners and operators are protected against financial loss in case of accidents or damages. By offering comprehensive protection, these policies enable peace of mind, allowing truckers to focus on their journeys without constant worry about potential pitfalls.

Customizing Your Policy: Creating a Tailored Heavy Truck Coverage

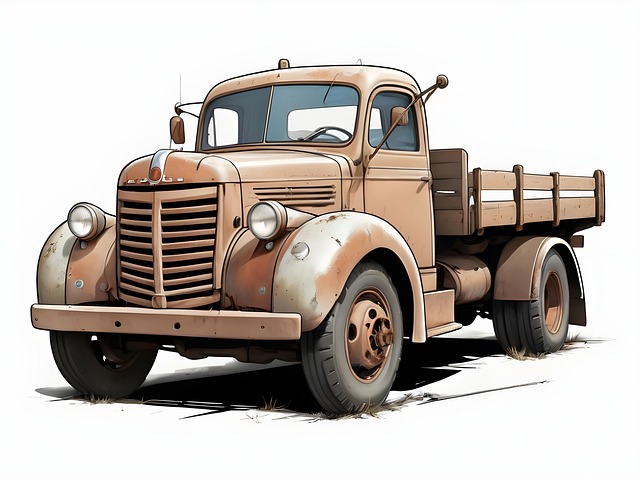

When it comes to insuring your heavy-duty trucking operations, one size does not fit all. That’s where specialized insurance agents come in—they help tailor a policy that aligns perfectly with your unique needs. Customizing your heavy truck insurance means going beyond the standard coverage to account for the specific risks and challenges associated with operating large vehicles and expensive equipment.

This might include provisions for oversized or hazardous cargo, comprehensive liability protection tailored to your fleet size and operations, and specialized coverages for mechanical breakdowns or loss of use while repairs are underway. A custom heavy-duty truck policy ensures that you’re not left vulnerable in the event of an accident, natural disaster, or equipment failure—protecting both your business and your bottom line.

Protecting Your Investment: Oversized Vehicle and Heavy Equipment Insurance Options

Protecting your investment is paramount when you’re in the business of trucking, especially with heavy-duty vehicles and specialized equipment. That’s where tailored insurance solutions come into play. Many standard insurance policies fall short when it comes to covering oversized vehicles and heavy machinery. This leaves truck owners vulnerable to significant financial losses in case of damage or accidents.

Specialized heavy-duty truck insurance offers comprehensive coverage for these unique assets. It includes protection against physical damage, liability claims resulting from accidents involving your large trucks, and even specific risks associated with transporting oversized cargo. A custom heavy-duty truck policy can be designed to meet the precise needs of trucking businesses, ensuring that their vehicles and equipment are shielded from potential hazards.

In conclusion, the unique risks associated with heavy-duty trucking demand specialized insurance solutions. By understanding these risks and customizing your policy to cover both your truck and heavy equipment, you can protect your investment effectively. Insuring oversized vehicles ensures that you’re prepared for any unforeseen circumstances, providing peace of mind on the road. Remember, a tailored heavy-duty truck insurance policy is key to navigating the challenges of this demanding industry.