Heavy-duty trucks and oversized vehicles require specialized heavy-duty truck insurance due to their unique risks. Traditional policies often don't cover specific needs like mechanical failures, cargo damage, or industry regulations. Custom heavy-duty truck policies offer tailored heavy truck coverage, specialized truck insurance, and oversized vehicle insurance, addressing legal requirements for large truck accidents. These policies protect vehicles, cargo, drivers, and associated assets like heavy equipment, ensuring comprehensive large vehicle protection.

In the realm of transportation, heavy-duty trucks and their specialized counterparts demand unique insurance considerations. Navigating the intricate landscape of heavy-duty truck insurance requires a deep understanding of the specific risks these vehicles pose. This article delves into the essential elements of large truck insurance, exploring tailored coverage for various fleets and the protection needed for oversized vehicles and heavy equipment. Discover how to create a custom heavy-duty truck policy that ensures comprehensive heavy truck coverage while addressing the distinct challenges of these powerful machines.

- Understanding the Unique Needs of Heavy-Duty Truck Insurance

- Types of Coverage for Large Trucks and Specialized Vehicles

- Creating a Custom Policy: Tailoring Protection for Your Fleet

- Protecting Oversized Vehicles and Heavy Equipment: Essential Considerations

Understanding the Unique Needs of Heavy-Duty Truck Insurance

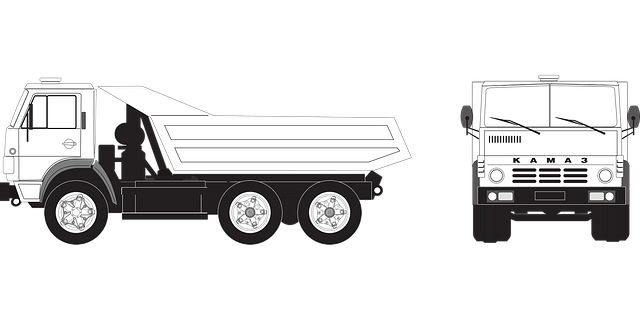

In the world of transportation, heavy-duty trucks play a vital role in moving goods across vast distances, from construction sites to delivery hubs. However, insuring these large vehicles presents unique challenges due to their size, specialized nature, and high-risk operations. Traditional insurance policies often fall short in addressing the specific needs of these oversized vehicles and the precious cargo they carry. Thus, a specialized heavy-duty truck insurance policy is imperative for fleet owners and operators.

Heavy-duty truck insurance covers not just the vehicle but also provides comprehensive protection for its intricate parts and specialized equipment. This includes insurance for heavy equipment attached to the truck, ensuring proper coverage during transportation or deployment. Additionally, a custom heavy-duty truck policy can offer liability protection against accidents involving these large vehicles, which often come with stringent legal requirements. The key lies in finding insurers who understand the nuances of this sector, offering tailored solutions that blend with the dynamic nature of heavy truck operations.

Types of Coverage for Large Trucks and Specialized Vehicles

When it comes to insuring heavy-duty trucks and specialized vehicles, there are several types of coverage options available that cater to unique risks associated with these types of assets. Heavy-duty truck insurance goes beyond standard vehicle policies, addressing specific needs such as comprehensive protection against mechanical failures, cargo damage, and liability for operations in diverse environments. This specialized coverage is crucial for businesses operating large trucks, ensuring they are prepared for unexpected events like accidents, natural disasters, or mechanical breakdowns.

Oversized vehicle insurance, for instance, is tailored to accommodate the unique challenges of transporting and insuring large equipment or vehicles that exceed standard dimensions. This includes heavy truck coverage for custom-built or modified vehicles, offering protection against risks specific to these specialized assets. Moreover, heavy equipment insurance is designed to safeguard machinery used in construction, agriculture, or other industries, addressing potential damages and liabilities during operation or transportation. A custom heavy-duty truck policy can be tailored to meet the precise requirements of each vehicle, ensuring comprehensive large vehicle protection.

Creating a Custom Policy: Tailoring Protection for Your Fleet

When it comes to insuring your fleet of heavy-duty trucks, a one-size-fits-all approach won’t cut it. That’s where specialized insurance for large trucks comes into play. Unlike standard vehicle policies, custom heavy-duty truck policies are designed to address the unique risks and needs associated with operating these oversized vehicles. This means comprehensive coverage for not just the truck itself but also its cargo, drivers, and any other assets specific to your operation, like heavy equipment or trailers.

Creating a custom policy allows insurers to tailor protection based on factors like vehicle type, usage (local hauls vs. cross-country journeys), and industry regulations. This level of customization ensures that you’re not paying for coverage you don’t need while also receiving robust protection when and where it matters most. Whether your fleet involves construction equipment, agricultural machinery, or specialized transport vehicles, a specialized truck insurance policy can be crafted to mirror the risks and responsibilities unique to each scenario.

Protecting Oversized Vehicles and Heavy Equipment: Essential Considerations

Protecting oversized vehicles and heavy equipment requires specialized insurance tailored to address unique risks. These assets, often crucial for construction, transportation, and logging, demand robust protection given their size, value, and operational challenges. Traditional insurance policies may not adequately cover potential damages, liabilities, or losses associated with these large vehicles and machinery.

A custom heavy-duty truck policy considers specific perils like roadside hazards, mechanical failures, and environmental damage, offering comprehensive coverage for both the vehicle and its cargo. Heavy truck coverage includes liability protection against third-party claims resulting from accidents, as well as physical damage to the truck itself. Moreover, specialized policies can accommodate unique needs, such as temporary storage, road risks, and even specific operational exclusions or limitations, ensuring that owners and operators are shielded against financial losses and legal repercussions.

When it comes to insuring heavy-duty trucks and their unique operations, a one-size-fits-all approach won’t cut it. Navigating the complexities of these vehicles and their specialized uses requires a tailored strategy. By understanding your specific needs – whether for large trucks, oversized loads, or heavy equipment – you can create a custom heavy-duty truck policy that offers comprehensive protection. This ensures peace of mind and safeguards against potential financial burdens associated with accidents, damage, or liability. Invest in a policy designed for these demanding circumstances to secure the future of your fleet.