Heavy-duty truck insurance is a niche sector catering to the unique risks of operating large vehicles over 26,001 pounds. These specialized policies address stringent regulations, diverse environments, and specific concerns like cargo value, driver experience, maintenance, and environmental damage potential. Customized coverage protects owners from financial losses and legal liabilities associated with high-risk operations, including accidents, natural disasters, theft, vandalism, and mechanical failures. A tailored heavy truck coverage or specialized truck insurance policy offers comprehensive protection for valuable assets, ensuring peace of mind and financial security.

In the realm of transportation, heavy-duty trucks and specialized vehicles play a vital role, yet they come with unique insurance challenges. This article navigates the intricacies of heavy-duty truck insurance, focusing on large truck insurance and specialized truck insurance. We explore types of coverage for oversized vehicles and heavy equipment, emphasizing the importance of a custom heavy-duty truck policy tailored to specific needs. By delving into these topics, we aim to protect your investment with comprehensive heavy truck coverage, ensuring peace of mind on the road.

- Understanding the Unique Challenges of Heavy-Duty Truck Insurance

- Types of Coverage for Large and Specialized Trucks

- Customizing Your Policy to Fit Specific Needs

- Protecting Your Investment: Key Benefits of Comprehensive Insurance for Heavy Vehicles

Understanding the Unique Challenges of Heavy-Duty Truck Insurance

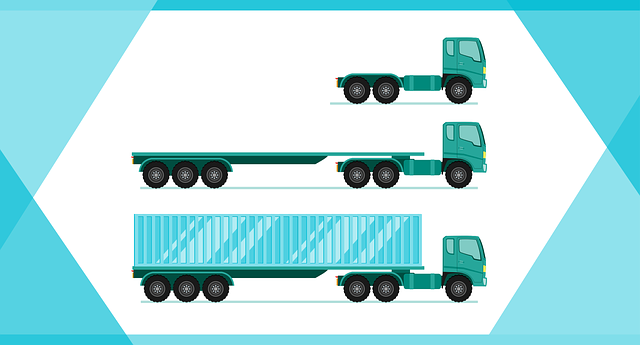

Heavy-duty truck insurance is a specialized field that addresses the unique risks and challenges associated with large vehicles and their operations. These trucks, often exceeding 26,001 pounds, present distinct issues when it comes to coverage. They are subject to stringent regulations and operate in diverse environments, necessitating tailored insurance solutions. The size and nature of these vehicles mean they require specialized equipment and custom heavy-duty truck policies to ensure comprehensive protection.

Oversized vehicle insurance and heavy equipment insurance are crucial components of this niche market. Insurers must consider factors like cargo value, driver experience, vehicle maintenance, and the potential for environmental damage in remote areas. A custom heavy-duty truck policy can incorporate specific needs, such as liability coverage for high-value freight, physical damage protection for specialized cargo, and backup and trailer coverage. This ensures that large truck owners and operators are protected against financial losses and legal liabilities inherent in their line of work.

Types of Coverage for Large and Specialized Trucks

When it comes to insuring large and specialized trucks, there are several types of coverage options available to meet specific needs. Heavy-duty truck insurance is designed to protect against comprehensive risks associated with these vehicles, which often include extensive mechanical components and specialized cargo. This type of policy can cover damage or loss due to accidents, natural disasters, theft, vandalism, and even roadside assistance.

For oversized vehicles and heavy equipment, specialized truck insurance offers tailored protection. This includes coverage for unique features such as custom modifications, specialized cargo like hazardous materials, and the increased liability that comes with operating large trucks. A custom heavy-duty truck policy ensures that owners have comprehensive large vehicle protection, addressing specific concerns related to their industry and operation.

Customizing Your Policy to Fit Specific Needs

When it comes to insuring your heavy-duty or specialized truck, a one-size-fits-all approach won’t cut it. These vehicles have unique characteristics and operate in diverse environments that require tailored coverage. Customizing your policy allows you to align your insurance with your specific needs, ensuring comprehensive protection for these valuable assets.

Consider factors such as the type of cargo carried, the vehicle’s size and weight, operating locations, and any specialized equipment onboard. For instance, if you haul oversized or hazardous materials, you’ll need extensive liability coverage and specific endorsements to address unique risks. Similarly, a specialized truck with custom modifications might require additional coverage for those alterations. By assessing these variables, you can create a custom heavy-duty truck policy that offers the right balance of protection and peace of mind.

Protecting Your Investment: Key Benefits of Comprehensive Insurance for Heavy Vehicles

Protecting your investment in a heavy-duty truck or specialized vehicle goes beyond regular maintenance and careful driving practices. Comprehensive insurance for these oversized vehicles offers crucial protection against a wide range of risks that are often overlooked. It’s not just about covering accidents; it encompasses damage from natural disasters, theft, vandalism, and even mechanical failures. This type of coverage ensures peace of mind by safeguarding your significant investment, which is often the backbone of businesses relying on heavy-duty trucks for their operations.

A custom heavy-duty truck policy tailored to your specific needs can include additional benefits like liability protection against third-party damages, medical payments for injuries sustained in an accident, and coverage for towing and labor expenses when repairs are needed. This comprehensive approach ensures that if the worst happens, you’re not left with a substantial financial burden. It’s essential to choose a policy that understands the unique challenges faced by owners of large vehicles and specialized equipment, providing them with the right balance between protection and affordability.

When it comes to insuring your heavy-duty truck, whether it’s a large fleet or a specialized rig, understanding the unique challenges and tailoring your policy accordingly is key. By combining comprehensive coverage with a custom approach, you can protect your substantial investment, ensuring peace of mind on the road. This tailored strategy addresses the specific needs of these vehicles, offering protection for both the equipment and the operators involved. With the right balance of heavy-duty truck insurance, you’re not just insuring a vehicle; you’re safeguarding an entire operation’s future.